New Information on PPP Loan Forgiveness

LOUISIANA REALTORS • April 25, 2020

Payroll Protection Program Forgiveness: Consult with you Certified Public Accountant

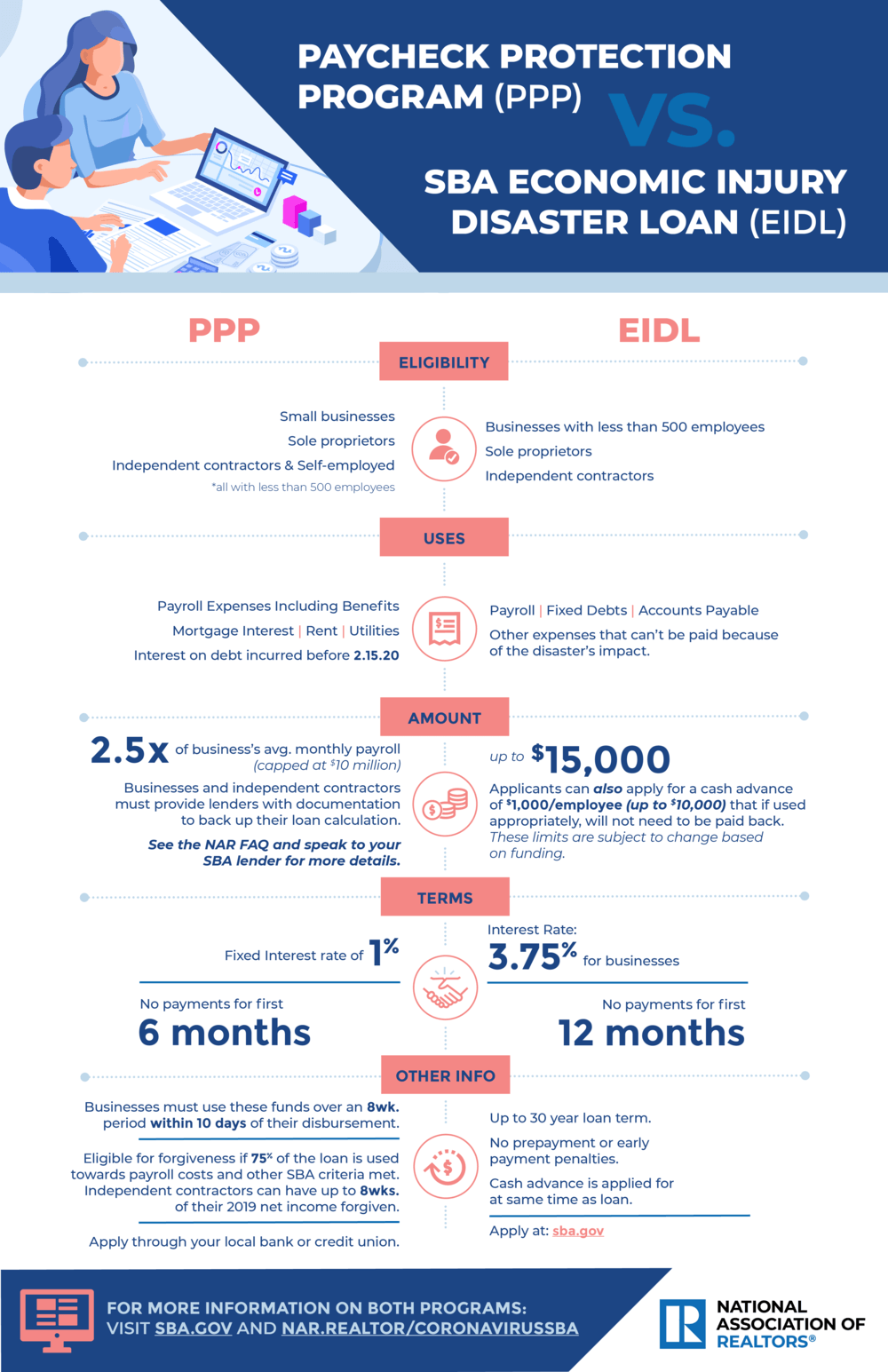

As part of the CARES Act, the Paycheck Protection Program (PPP) has allowed for significant aid to many small businesses during the COVID-19 crisis. One of the main benefits of the PPP loan program is the ability to have some or all of the loan forgiven. However, if not utilized pursuant to the CARES Act and related government rules, loan forgiveness may not be possible.

This is why the ability to understand and apply PPP funds received appropriately is critical. Every agent or broker who has received these funds will have a different set of circumstances and concerns. Accordingly, Louisiana REALTORS® encourages you to consult with your Certified Public Accountant about loan forgiveness if you or your office has received PPP funds.

SBA Issues New PPP FAQs

The Small Business Administration, in consultation with the United States Treasury Department, released an updated set of FAQs about the Paycheck Protection Program. The FAQs address concerns about eligibility, acceptance of signatures on behalf of borrowers, borrowers that contract with payroll providers, loans applied for or received based upon previous issued guidance and more. The updated guidance can be found here:

Paycheck Protection Program (PPP) Lending Operations Update – Wednesday, April 29, 2020

SBA and Treasury value all lenders and their small business customers.

To ensure access to the PPP loan program for the smallest lenders and their small business customers, starting at 4 p.m. today EDT through 11:59 p.m. EDT, SBA systems will only accept loans from lending institutions with asset sizes less than $1 billion dollars.

Please note, lending institutions with asset sizes less than $1 billion will still be able to submit PPP loans outside of this time frame. Please also note that lenders with asset sizes greater than $1 billion will be able to submit loans outside of today's 4pm -11:59pm EDT reserved processing time.

This reserved processing time applies today April 29, 2020. SBA and Treasury will evaluate whether to create a similar reserved time again in the future.

SBA and Treasury continue to monitor loan system performance and will continue to provide frequent updates to the lending community.

On Monday, April 27th at 9:30 a.m. CST, the Small Business Administration will resume accepting Paycheck Protection Program loan applications from approved lenders on behalf of any eligible borrower. This does not necessarily mean that your bank will be accepting or processing applications at that time, but that they will be able to do so. If you are planning to apply or have applied for a PPP loan, we encourage you to visit your bank Monday morning and to inquire if they are accepting or processing PPP applications. Be sure to have your application in order along with any supporting paperwork.

For more guidance on applying for the PPP or EIDL, please see:

From the Louisiana Department of Insurance: Insurance Commissioner Tim Temple announced today that the Louisiana Department of Insurance (LDI) continues its work to develop a regulation creating benchmark discounts for Fortified roofs in Louisiana. The LDI is working with the National Association of Insurance Commissioners (NAIC) to develop the benchmark discounts using Louisiana-specific data, hurricane modeling and actuarial considerations. “With over 11,000 Fortified roofs in Louisiana and two years-worth of insurer experience with rating for those roofs in our state, now is an appropriate time for the LDI to establish benchmark discounts for homeowners insurance companies operating in our market,” said Commissioner Temple. “These benchmarks are being thoughtfully developed to help consumers receive the discounts they deserve for fortifying their homes while making sure insurers know the benchmarks reflect how much Fortified roofs actually mitigate their exposure to risk across Louisiana.” Like in Alabama’s Fortified benchmark discount structure, the LDI regulation would require Louisiana insurance companies to either meet the minimum benchmark discount established by the LDI or provide actuarial justification for why the company’s discount does not meet the benchmark. Louisiana is the fastest growing state for Fortified roofs in America. To date, over 11,000 Fortified roofs have been installed in Louisiana, including over 4,100 through the Louisiana Fortify Homes Program.