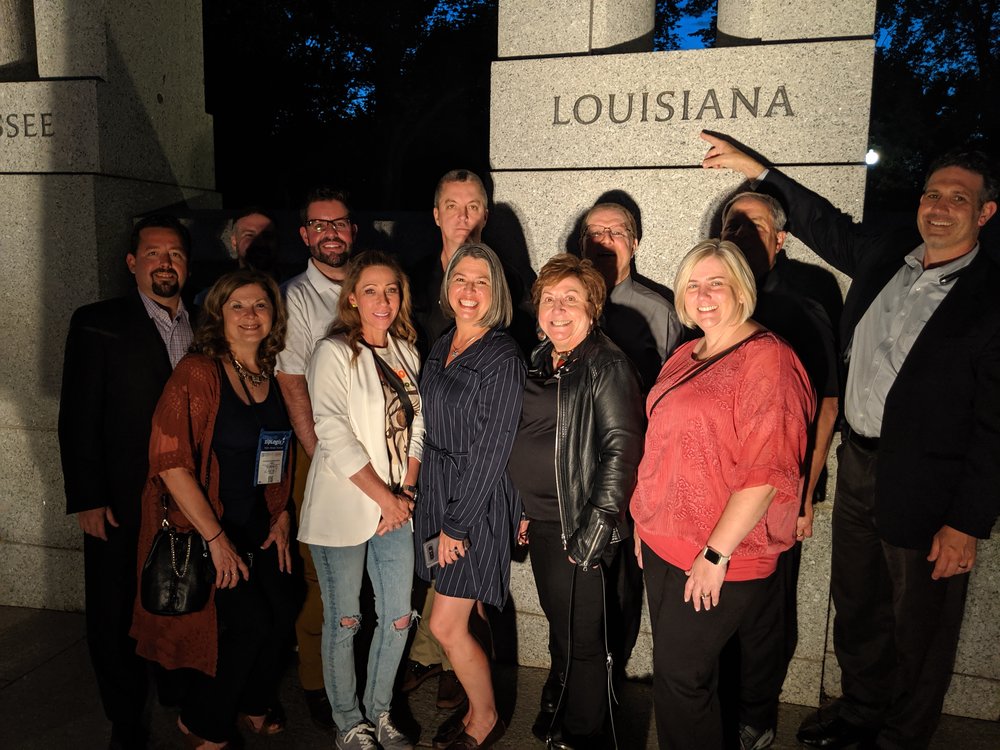

Recap NAR 2019 Legislative Meetings in Washington, D.C.

Louisiana had a number of representatives attend legislative meetings in Washington, D.C. during the month of May. Several members serve on national committees and brought back reports of activities and items covered. Valuable information regarding issues are covered in the various meetings and the attendees also took time to hear from Louisiana’s congressional delegation. The following provides a recap of some key items to note:

National Association of REALTORS Board of Directors

NAR Directors: Beth Cristina, Amanda Hanemann, Connie Kyle, LaTanya Labranch, Marbury Little, Logan Morris, Andrea McKey, Matt Ritchie, Rick Roberts, Jeffrey Welsh, and Curtis Wright

The National Association of REALTORS® Board of Directors approved a three-year extension of the $35-per-member annual special assessment to fund its national ad campaign through 2022. The vote comes as the power of NAR’s campaign message, “

The board also approved the 2020 NAR budget with no dues increase and a Finance Committee recommendation that NAR return to a more prudent 50% reserve requirement of gross operating expense (from the current 40%) and target a 75% reserve. The 2019 budget adds $11.5 million back to NAR’s reserves. For 2020, membership is budgeted at 1,340,000, and annual dues remain at $150.

Federal Priority Issues Briefing

NAR’s head of lobbying along with a panel of subject experts gave a very clear picture of what NAR is focused on regarding our lobbying efforts and shared similar positive feedback that NAR is having a positive impact on the Hill. Flood insurance, Opportunity zones, data privacy, expanded access to association health plans, GSE reform, Federal taxation and fair housing were all discussed.

Federal Finance & Housing Policy Committee

The Federal Finance & Housing Policy Committee is focused on key issues such as FHA and VA underwriting. There was great discussion regarding encouraging our elected officials to soften rules on how FHA excess reserves should be used in the future. The committee believes the reserves should be used to improve FHA’s operations for borrowers and lenders and not swept into the general treasury. The committee discussed their continued push for rule changes regarding Condos, FHA technology and Rural Housing.

Federal Housing Visit - recap provided by committee member, Scott Friestad

Members heard from Tracy Kasper, VP of Advocacy for NAR; HUD Deputy Secretary Brain Montgomery; Gisele Roget, Deputy Assistant Secretary for Single Family Housing; John Bell III, Deputy Director of VA Loan Guaranty Service and Cathy Glover, Assistant Deputy Administrator, USDA Single Family Housing.

The leadership from HUD and FHA stated that we would see new Condo Rules released in the next few months, in line with NAR’s guidance. They also shared FHA Underwriting changes that have been enacted but are on a 90 day hold period. They include new rules that will require manual underwriting for those with less than a 620 score and a DTI greater than 43%. Recent studies show that these individuals pose a risk of loan default with credit scores under 620 and DTI greater than 43%. Currently 25% of FHA’s loan portfolio is made up of loans with DTI over 50%, the highest since 2000. The average credit scores have also decreased in the same time period. Ideally, FHA would like to see credit scores higher than 680 and DTI lower than 43%. HUD has also changed down payment Assistance rules through government entities. This rule change is on hold pending ongoing litigation between HUD and a Native American entity. FHA has also released proposed revisions to the FHA Loan-Level certifications creating an easier to read format with the end goal of the change to provide additional clarity and streamline FHA requirements while maintaining the financial footing of the Mutual Mortgage Insurance Fund.

Broker Risk Reduction- Risk Management Committee Chaired by Lynda Nugent Smith

Wire Fraud

During this meeting, different ways of protecting yourself from wire fraud and violating TCPA and DNC laws (laws regarding texting and calling) were discussed.

NAR provides an excellent video to help reduce the risk of wire fraud: Wire Fraud Alert for Buyers. Always use good security practices and encourage your clients to do the same. A few other great tips discussed were to avoid sending sensitive financial information or wiring instructions via email, use a secure platform to share documents and information, and immediately report suspected fraud to the bank from which the funds were transferred. In addition to notifying a bank, you should report fraud incidents on the Internet Crime Complaint Center (IC3) at http://www.ic3.gov.

Other great security resources include:

Telephone Consumer Protection Act and Do Not Call Laws

To reduce the risk of violating TCPA:

· Obtain written consent before using an auto dialer to send a commercial message

· Include language on consent forms stating that recipients who submit wireless numbers agree to receive text messages from on behalf of the sender.

· Allow recipients to easily cancel or opt-out (e.g., by responding with “STOP” or UNSUBSCRIBE”

· Set email alerts to document when subscribers opt-out.

· Upon receiving an aopt-out request, promptly remove the person from your message lists.

· Record the opt-out date and date when the person was removed.

· Talk to your vendor about compliance and indemnification

To reduce risk of violating DNC

· Create an office policy for compliance with Do Not Call rules

· Obtain and updated DNC list monthly and cross reference with your company CRM