NFIP Extended A Week to Prevent Lapse

LOUISIANA REALTORS • November 30, 2018

Louisiana Senators Bill Cassidy and John Kennedy continue to be key players in negotiations and we thank them for taking the lead on this key issue!

Flood Insurance Program extended at least another week

CONTACT US

The Advocate By: Bryn Stole

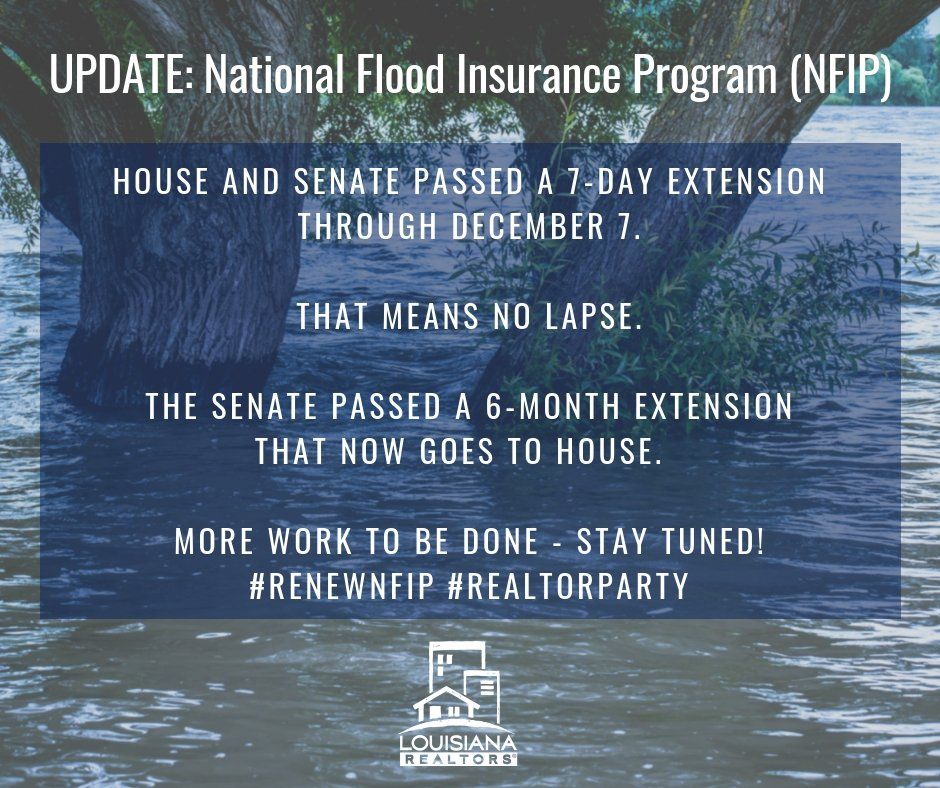

Congress pushed back its deadline to deal with the National Flood Insurance Program by at least a week, passing yet another short-term extension of the program late Thursday.

A deadline to avoid a lapse in the federal program, which underwrites most flood insurance coverage in the country and covers a half-million Louisiana homes, had been looming at midnight on Friday. The short-term deal is the eighth temporary extension for the program since it first came up for periodic renewal more than a year ago.

Louisiana Sens. Bill Cassidy and John Kennedy had pushed for a six-month extension of the program, putting off a deadline until the spring and giving new incoming leadership in the House of Representatives time to get to work on a comprehensive overhaul of the program.

Both the House and Senate passed a week-long extension on Thursday evening. The Senate also passed the six-month deal, meaning the House could come back Friday or next week and pass the longer extension as well.

No long-term deal over the beleaguered flood insurance program — which is mired in billions of debt from payouts for past hurricanes — is expected in the coming weeks. But lawmakers will need to strike an agreement on just how long to extend it.

Lawmakers have remained deadlocked for more than a year over long-term reforms to the program. <<Read the Full Article>>

From the Louisiana Department of Insurance: Insurance Commissioner Tim Temple announced today that the Louisiana Department of Insurance (LDI) continues its work to develop a regulation creating benchmark discounts for Fortified roofs in Louisiana. The LDI is working with the National Association of Insurance Commissioners (NAIC) to develop the benchmark discounts using Louisiana-specific data, hurricane modeling and actuarial considerations. “With over 11,000 Fortified roofs in Louisiana and two years-worth of insurer experience with rating for those roofs in our state, now is an appropriate time for the LDI to establish benchmark discounts for homeowners insurance companies operating in our market,” said Commissioner Temple. “These benchmarks are being thoughtfully developed to help consumers receive the discounts they deserve for fortifying their homes while making sure insurers know the benchmarks reflect how much Fortified roofs actually mitigate their exposure to risk across Louisiana.” Like in Alabama’s Fortified benchmark discount structure, the LDI regulation would require Louisiana insurance companies to either meet the minimum benchmark discount established by the LDI or provide actuarial justification for why the company’s discount does not meet the benchmark. Louisiana is the fastest growing state for Fortified roofs in America. To date, over 11,000 Fortified roofs have been installed in Louisiana, including over 4,100 through the Louisiana Fortify Homes Program.