COVID-19 SBA Programs Funding Dries Up

LOUISIANA REALTORS • April 17, 2020

The $349 billion authorized in the CARES Act for Paycheck Protection Program loans has been exhausted. It is reported that loan applications received by banks but not yet submitted to SBA will not be able to be completed, and the agency will not maintain a queue for PPP applications if additional funds are authorized. Any loan applications that have received an SBA authorization number may be able to receive an SBA guaranty, however.

Also, the SBA is unable to accept new applications at this time for the Economic Injury Disaster Loan (EIDL)-COVID-19 related assistance program (including EIDL Advances) based on available appropriations funding. Applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis.

Aware of the looming shortfall, the National Association of REALTORS® sent a letter to lawmakers on Monday, April 13th seeking more funds to keep the programs operating. Louisiana REALTORS® is monitoring the situation and will provide updates when information is available and confirmed.

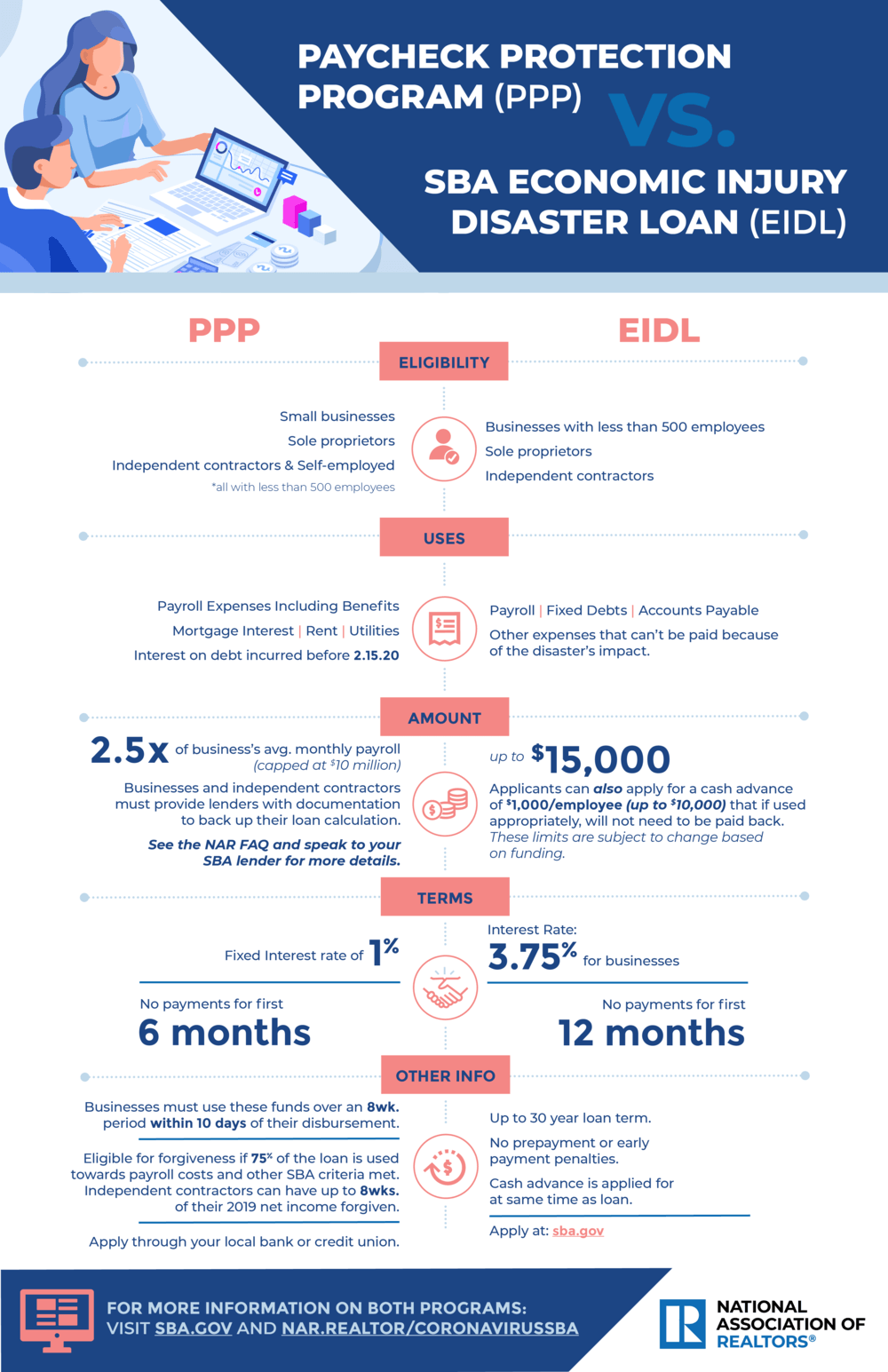

In the meantime, reference this infographic to see information about each of the available programs.

From the Louisiana Department of Insurance: Insurance Commissioner Tim Temple announced today that the Louisiana Department of Insurance (LDI) continues its work to develop a regulation creating benchmark discounts for Fortified roofs in Louisiana. The LDI is working with the National Association of Insurance Commissioners (NAIC) to develop the benchmark discounts using Louisiana-specific data, hurricane modeling and actuarial considerations. “With over 11,000 Fortified roofs in Louisiana and two years-worth of insurer experience with rating for those roofs in our state, now is an appropriate time for the LDI to establish benchmark discounts for homeowners insurance companies operating in our market,” said Commissioner Temple. “These benchmarks are being thoughtfully developed to help consumers receive the discounts they deserve for fortifying their homes while making sure insurers know the benchmarks reflect how much Fortified roofs actually mitigate their exposure to risk across Louisiana.” Like in Alabama’s Fortified benchmark discount structure, the LDI regulation would require Louisiana insurance companies to either meet the minimum benchmark discount established by the LDI or provide actuarial justification for why the company’s discount does not meet the benchmark. Louisiana is the fastest growing state for Fortified roofs in America. To date, over 11,000 Fortified roofs have been installed in Louisiana, including over 4,100 through the Louisiana Fortify Homes Program.